When we moved to from Ontario Canada, to California in 2000, we had already started investing in real estate, but were very primarily focused on our tech careers. My wife and I both worked in tech, me as a software developer and my wife as a graphic designer. We sold everything and drove across the country.

When we moved to from Ontario Canada, to California in 2000, we had already started investing in real estate, but were very primarily focused on our tech careers. My wife and I both worked in tech, me as a software developer and my wife as a graphic designer. We sold everything and drove across the country.

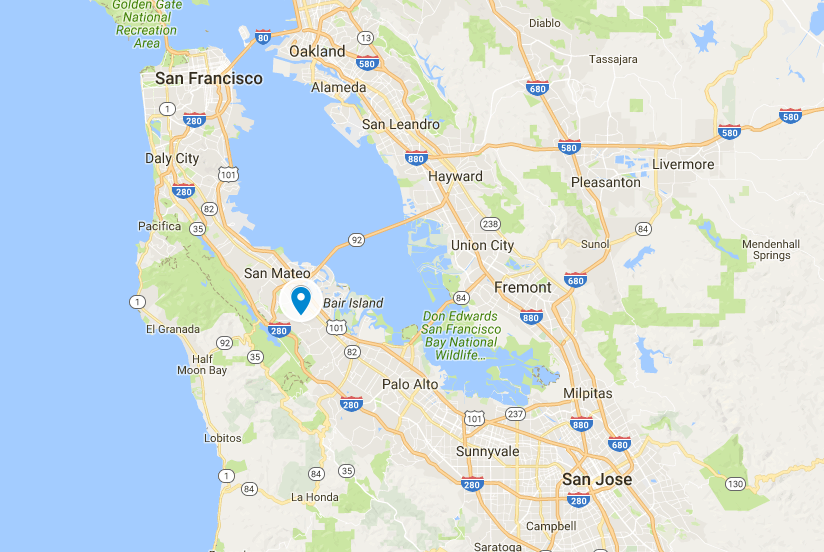

Given that we were new to the country, we weren’t able to buy a house for 2 years, at which point we had enough credit history to qualify at the bank (note that I had known about RTO, I might have purchased sooner!). For the first two years, we rented, and enjoyed the beauty that is California (see sunset photo taken of the sunset over the pacific ocean from highway 280).

As soon as we could we bought in Belmont, one of the nicer cities along the peninsula, south of San Francisco and north of San Jose. The area was showing amazing appreciation, and we knew we could turn this dilapidated home into something pretty amazing. In a sellers market, getting the home was not easy. We did everything we do win the deal; few conditions, wrote a note to the owner stating our story, and a good asking price among other things. We lost the deal….but a few days later, my wife found the deal back on the market! The deal fell through and we jumped on it quick and won the deal.

pretty amazing. In a sellers market, getting the home was not easy. We did everything we do win the deal; few conditions, wrote a note to the owner stating our story, and a good asking price among other things. We lost the deal….but a few days later, my wife found the deal back on the market! The deal fell through and we jumped on it quick and won the deal.

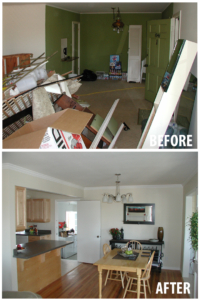

In this particular flip, we did 90% of the work ourselves. The only thing we hired for was tree removal, the sprinkler system, and exterior painting. That left demolition, plumbing, gas, electrical, drywall, mud, painting, kitchen, bathroom, fireplace, tile, crown etc etc which we did ourselves.

Here are some before and after photos from this flip (click on the images to see larger versions):

When we bought the house, the front yard was so overgrown that the house was hard to see. We immediately hired someone to trim the shrubs to increase curb appeal.

When we bought the house, the front yard was so overgrown that the house was hard to see. We immediately hired someone to trim the shrubs to increase curb appeal.

My wife and I were driving down the hill to our house that evening after the work had been done and the front yard was empty! They didn’t trim, they removed…everything! It was so drastically different, that we drive right by our house without realizing it. A project just wouldn’t be complete without some surprises.

The back yard was small but we were able to make use of the space, and still allow the deer to periodically snack on the lemon and orange trees.

The fireplace was one of my favorite projects. A nice transformation with a custom built mantel and slate tiles.

The fireplace was one of my favorite projects. A nice transformation with a custom built mantel and slate tiles.

The realtor that sold the house to us, was a friend. I think she thought we were a little crazy for buying a home that needed so much work. She was partially confused by what we were doing and partly appreciative, and recommended that we keep flip flops on while using the existing shower. We had a lot of fun turning this bathroom into a new room with a stand up shower and soaker tube.

The realtor that sold the house to us, was a friend. I think she thought we were a little crazy for buying a home that needed so much work. She was partially confused by what we were doing and partly appreciative, and recommended that we keep flip flops on while using the existing shower. We had a lot of fun turning this bathroom into a new room with a stand up shower and soaker tube.

In the dining room we installed a header in the wall leading the kitchen to open it up and make room for an island. Ultimately our goal was to make a more open concept and more inclusive eating area.

In the dining room we installed a header in the wall leading the kitchen to open it up and make room for an island. Ultimately our goal was to make a more open concept and more inclusive eating area.

The kitchen was all new cabinets, appliances, gas, electrical, tile flooring and corian counter tops.

The kitchen was all new cabinets, appliances, gas, electrical, tile flooring and corian counter tops.

The house was 100% refurbished when we were done, and during that time, the market was appreciating at ~20/25% annually. We enjoyed the full effect of both when we sold. Given that we purchased the home with very little money down, our ROI was extremely high. This was before we were doing investing full time, but we knew enough to do our homework, go in with our eyes open and manage the risk (forcing appreciation among other things). Yes there was risk, but there’s risk in crossing the street, or in doing nothing….and nothing ventured, nothing gained.

Today we invest more strategically and use the lessons learned in projects like this to ensure that we and our investors are secure. What did we learn? Forcing appreciation (especially quickly) is invaluable, hiring trades is a must to move faster, and markets that appreciate well are a nice perk (but not a must) when you get them!

If you’re interested to learn more about investing in real estate, feel free to contact us here.